Introduction

Sonnet Biotherapeutics Holdings Inc (NASDAQ: SONN) is a clinical-stage biotechnology company headquartered in Princeton, New Jersey. The firm develops targeted immuno-oncology drugs utilizing its proprietary FHAB™ (Fully Human Albumin-Binding) platform, which is designed to enhance the immune response to tumors. As of September 16, 2025, Sonnet’s shares traded at $7.00, reflecting an increase of 26.35% on a volume of 2,679,214.

Corporate Structure

Sonnet employs between 11 and 50 professionals across research, clinical development, and corporate functions. The leadership team includes Nailesh Bhatt as Chairman of the Board and Raghu Rao serving as Interim Chief Executive Officer. The company holds a license agreement with New Life Therapeutics Pte. Ltd. for a recombinant human interleukin-6 program and maintains a strategic collaboration with Sarcoma Oncology Center to advance its SON-1210 candidate.

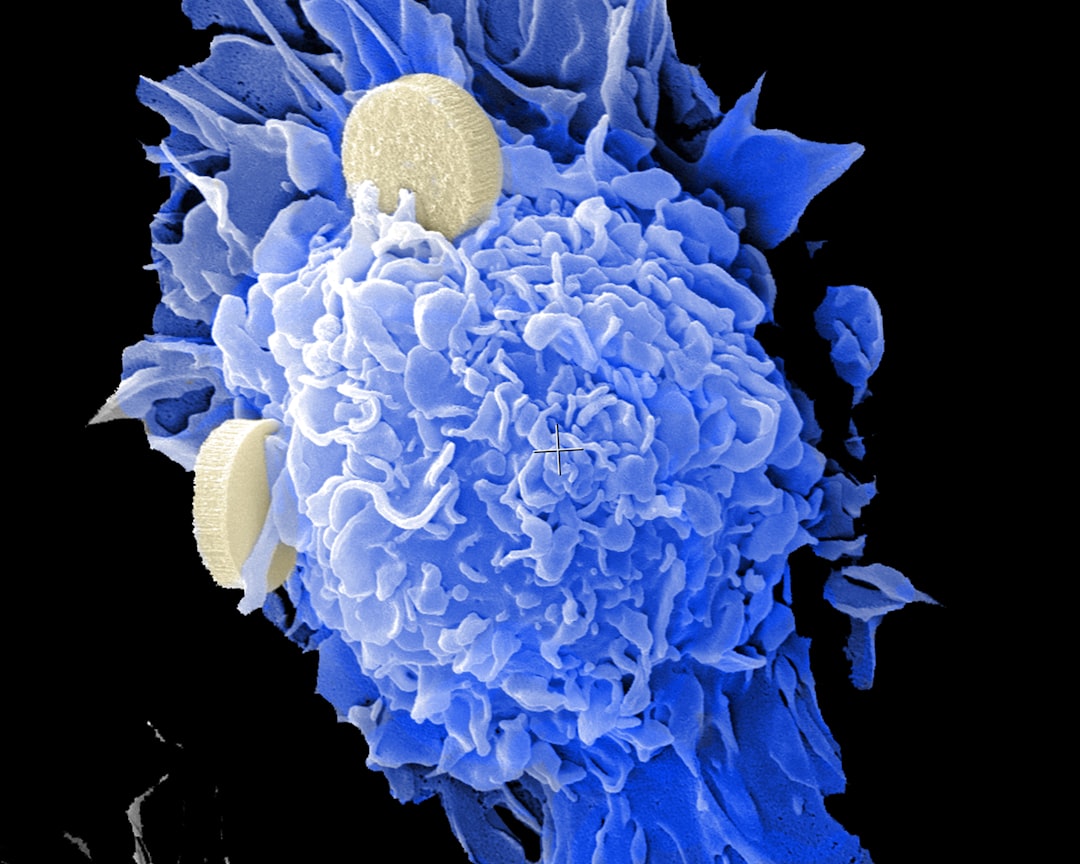

Immuno-oncology by National Cancer Institute

Developments and News

On July 14, 2025, Sonnet entered into a definitive Business Combination Agreement with Rorschach I LLC to establish Hyperliquid Strategies Inc (HSI). Under the agreement:

- HSI will hold approximately 12.6 million HYPE tokens valued at $583 million, based on spot prices at the time of signing.

- A minimum of $305 million in gross cash proceeds will be contributed at closing, amounting to a total assumed value of $888 million.

- Bob Diamond will be appointed as Chairman of the Board, and David Schamis will serve as Chief Executive Officer of HSI.

- Sonnet will raise $5.5 million on July 14, 2025, through a private placement of non-voting convertible preferred stock and warrants.

In August 2025, Sonnet filed its Quarterly Report on Form 10-Q (August 13, 2025) and its Annual Report to Security Holders (Form ARS) and a definitive proxy statement (Form DEF 14A) on August 26, 2025.

Financial and Strategic Analysis

Sonnet is currently in the pre-revenue stage, funding operations through equity offerings, private placements, and strategic alliances. Its business combination with Rorschach I LLC indicates a shift toward a cryptocurrency treasury reserve model. While the $888 million valuation and $5.5 million private placement are expected to enhance liquidity, they also bring exposure to the volatility of digital assets. Ongoing collaborations—such as the interleukin-6 license with New Life Therapeutics and the Sarcoma Oncology Center partnership—support research investment; however, sustained capital and progress in clinical trials will be essential for long-term success.

Market Position and Industry Context

Within the immuno-oncology sector, Sonnet’s pipeline includes five clinical-stage candidates: SON-1010 (IL-12), SON-080 (IL-6), SON-1210 (bispecific), SON-1411 (IL-18/IL-12 fusion), and SON-1400 (IL-18 binding protein). These candidates utilize the FHAB platform to potentially enhance half-life and tumor targeting. Competition within the cytokine-based therapy landscape is significant due to the presence of larger pharmaceutical companies and other biotech firms, leading to rigorous and competitive regulatory approval pathways. Sonnet’s proprietary delivery technology and strategic partnerships provide differentiation; however, limited financial reserves and the complexities of clinical trials pose challenges to execution.

tl;dr

On July 14, 2025, Sonnet Biotherapeutics agreed to merge with Rorschach I LLC to create Hyperliquid Strategies Inc, establishing a public cryptocurrency treasury valued at $888 million while raising $5.5 million. Shares increased 26.35% to $7.00 on September 16, 2025. The company has five clinical-stage oncology candidates powered by its FHAB platform. The effectiveness of the cryptocurrency treasury strategy and forthcoming clinical milestones will influence Sonnet’s performance in the coming year.