Introduction

Co-Diagnostics, Inc. (NASDAQ: CODX), founded in 2013 and headquartered in Salt Lake City, Utah, develops and markets real-time polymerase chain reaction (PCR) diagnostics. Leveraging its proprietary Co-Primers® technology, the company offers on-site and at-home PCR testing platforms designed to detect infectious diseases, support research applications, and control vector-borne pathogens.

Corporate Structure and Operations

Co-Diagnostics employs between 51 and 200 people, including scientists focused on multiplex PCR assay development. Its product portfolio encompasses:

- In vitro diagnostic (IVD) tests compliant with local regulatory requirements

- Research-use-only (RUO) infectious disease detection kits

- Vector control solutions for same-day mosquito-borne virus testing

- The Co-Dx Box®, a portable qPCR cycler with magnetic induction technology

The company’s mission is to increase access to molecular diagnostics by making high-quality PCR testing available and affordable, particularly in underserved regions.

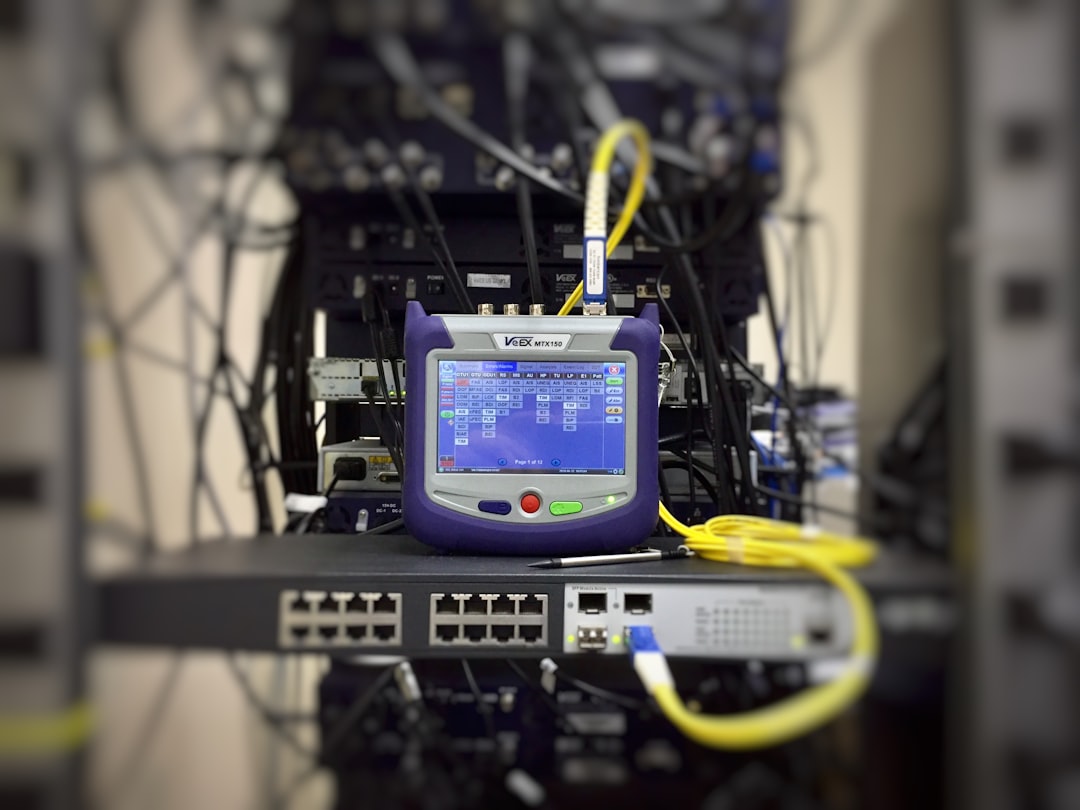

PCR Testing by Ildefonso Polo

Developments and News

- January 14, 2025: CEO Dwight Egan appeared on Nasdaq Listings with host Kristina Ayanian at the Silicon Slopes Summit, discussing Co-Dx’s real-time PCR capabilities.

- February 4, 2025: Joint venture CoSara Diagnostics Pvt. Ltd. hosted a cancer awareness lecture series in India.

- March 6, 2025: The U.S. District Court for the District of Utah granted summary judgment in favor of Co-Diagnostics, dismissing a securities class action alleging misleading COVID-19 test accuracy claims.

- August 14, 2025: Filing of Form 10-Q for the quarter ended June 30, 2025, detailing operational results and liquidity position.

- September 16, 2025: Filing of a Prospectus Supplement (Rule 424(b)(5)), authorizing the sale of up to $17,111,650 in common stock under the existing Equity Distribution Agreement.

Financial and Strategic Analysis

As of September 17, 2025, CODX shares traded at $0.4740, a 25.80% decline on a volume of 8,911,619 shares. Key metrics from Yahoo Finance include:

- Market Capitalization: $18.68 million

- Price/Sales (ttm): 20.13

- Price/Book (mrq): 0.60

- Beta (5-year): 0.79

- Revenue (ttm): $1.0 million

- Net Loss (ttm): $35.99 million

- Total Cash (mrq): $13.36 million

- Total Debt/Equity (mrq): 4.14%

In the September 16 prospectus, management noted $1.71 million of shares sold under the prior distribution agreement and confirmed the suspension of further sales pending a new prospectus supplement. This pause indicates a cautious approach to capital raising, balancing potential dilution against funding needs for R&D and commercial expansion.

Market Position and Industry Context

Co-Diagnostics operates within the medical and diagnostic laboratories sector, where real-time PCR is considered a key method for infectious disease testing. With over 34 million PCR tests sold to date, the company competes alongside established diagnostics firms and newer point-of-care innovators. The company was recognized as a Healthcare & Life Sciences honoree by Utah Business in 2025 for its advancements in portable PCR solutions. Co-Dx’s focus on at-home testing, point-of-care platforms, and vector control aligns with demand for decentralized diagnostics in both developed and emerging markets.

tl;dr

On September 16, 2025, Co-Diagnostics filed a prospectus to raise up to $17.1 million, having sold $1.7 million of stock to date and suspended further distribution. Trading at $0.4740 on September 17, 2025, CODX shares reflect a 25.80% drop amid a $1 million revenue run rate and a $35.99 million TTM net loss. The March 6 dismissal of a securities lawsuit removed a legal uncertainty, while the August 14 Form 10-Q detailed cash reserves of $13.36 million and modest debt. Investors will monitor the timing and size of any resumed offerings as the company advances its at-home and point-of-care PCR platforms.