Introduction

DRAGONFLY ENERGY HOLDINGS CORP (NASDAQ: DFLI) is a Reno, Nevada–headquartered company founded in 2016 that designs, assembles, and integrates lithium iron phosphate (LiFePO₄) battery systems. The firm serves original equipment manufacturers (OEMs) across applications such as recreational vehicles, heavy-duty trucking, marine use, and off-grid residential power. Dragonfly Energy emphasizes domestic cell manufacturing, patented processes, and sustainability in its product offerings.

Corporate Structure

Dragonfly Energy employs between 51 and 200 people, according to its LinkedIn profile. Over more than ten years of research and development, the company has built an intellectual property portfolio of approximately 100 granted, filed, or pending patents. Its leadership team participates in industry events such as The Battery Show North America 2025 and Battery Day 2025, reflecting a focus on technical expertise and stakeholder education.

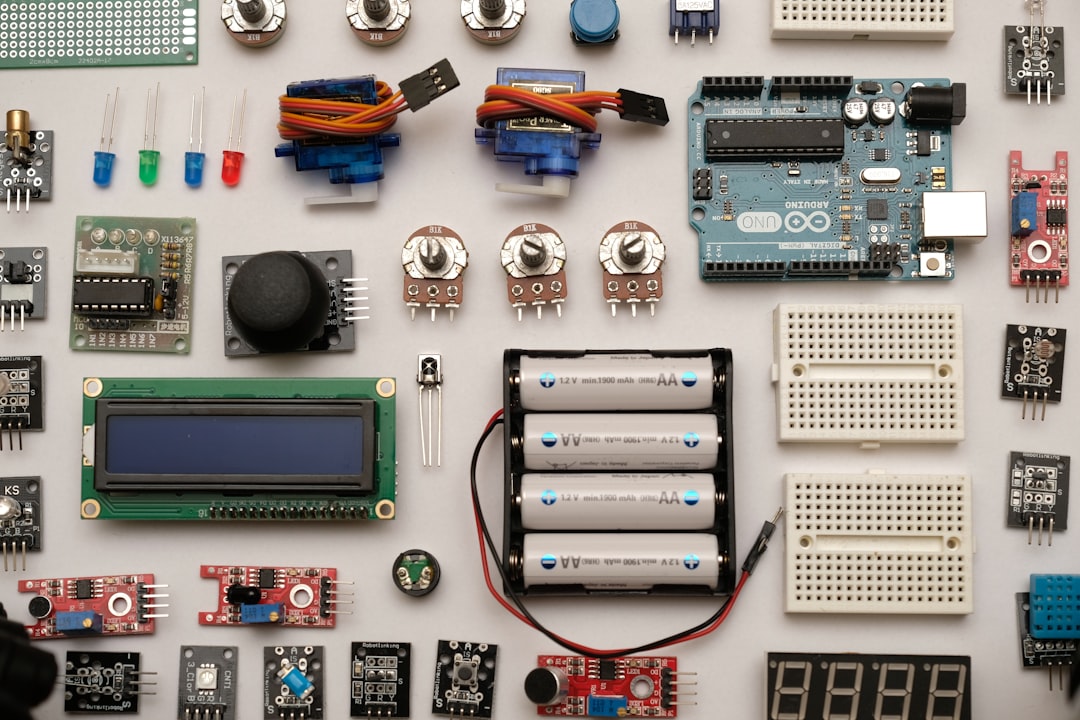

Lithium battery by Robin Glauser

Developments and News

- On September 15, 2025, Dragonfly Energy filed its Annual Report to Security Holders (Form ARS) and definitive proxy statements (Form DEF 14A) with the U.S. Securities and Exchange Commission.

- The company reported deployment of over 400,000 battery packs in the field and more than $225 million in revenue since 2021, with an average annual OEM growth rate of 179 percent over the same period.

- Dragonfly’s website highlights a proprietary dry electrode battery cell manufacturing process that is chemistry-agnostic and eliminates toxic N-methyl-2-pyrrolidone (NMP) solvent. The process delivers a 9 percent reduction in carbon footprint and 25 percent lower energy consumption compared with conventional methods.

- As of September 29, 2025, Dragonfly Energy’s stock price on NASDAQ rose 35.45 percent to $0.7091 on trading volume of 15,051,472 shares.

Financial and Strategic Analysis

Dragonfly Energy’s trailing twelve months (TTM) financial metrics, as reported by third-party sources, include:

| Metric | Value |

|---|---|

| Stock Price (09/29/2025) | $0.7091 (+35.45%) |

| Market Capitalization | $32.322 million |

| Shares Outstanding | 61.74 million |

| Volume (10-day average) | 24.36 million |

| 52-Week Range | $0.15 – $5.78 |

| Revenue (TTM) | $54.536 million |

| Gross Margin (TTM) | 25.56 percent |

| Net Margin (TTM) | –55.84 percent |

| EPS (TTM) | –$3.87 |

| P/E Ratio (TTM) | –0.14 |

| Debt to Equity (MRQ) | 254.75 percent |

Strategically, Dragonfly Energy leverages an integrated systems approach, combining battery packs with ancillary components to provide energy storage solutions. The company’s domestic dry electrode technology aims to reduce reliance on overseas suppliers and to support future advancements in solid-state batteries. Its product line, marketed under the Battle Born® brand, replaces lead-acid batteries with lightweight lithium systems designed for deep-cycle applications.

Market Position and Industry Context

Dragonfly Energy operates within the North American lithium battery manufacturing sector, a market influenced by electrification trends in transportation, renewable energy integration, and off-grid applications. The shift from lead-acid to lithium technology has resulted in increased demand for LiFePO₄ batteries, which are noted for durability and safety. Competing manufacturers include established battery producers and emerging domestic cell manufacturers pursuing advanced chemistries and manufacturing efficiencies. Dragonfly’s focus on patented processes, sustainability, and U.S.-based production aligns with industry trends towards localized supply chains and environmental considerations.

TL;DR

As of September 29, 2025, DFLI shares increased by 35.45 percent to $0.7091 on NASDAQ. The company filed its Annual Report (Form ARS) and proxy statements on September 15, 2025, and reported over $225 million in revenue since 2021. Dragonfly Energy’s proprietary dry electrode manufacturing process offers a 9 percent reduction in carbon footprint and supports future solid-state cell development. An earnings release is scheduled for November 12, 2025.