Introduction

LEAP THERAPEUTICS INC (NASDAQ: LPTX) is a clinical-stage biopharmaceutical company headquartered in Cambridge, Massachusetts. The company focuses on developing targeted and immuno-oncology therapeutics. LEAP's lead candidate is sirexatamab (DKN-01), a humanized monoclonal antibody targeting the Dickkopf-1 (DKK1) protein. Additional programs include FL-301, which targets Claudin18.2 in gastric and pancreatic cancers, and FL-501, an anti-GDF-15 antibody that is currently in preclinical development.

Corporate Structure

LEAP has 11–50 employees and operates with a team of scientists, clinicians, and business professionals. Douglas Onsi serves as President and CEO, supported by a board that includes healthcare investors and oncology experts such as William Li, MD, and Joseph Loscalzo, MD, PhD, MA. The Scientific Advisory Board comprises professionals from institutions including Cold Spring Harbor Laboratory, Weill Cornell Medical College, Duke University, and Memorial Sloan Kettering Cancer Center.

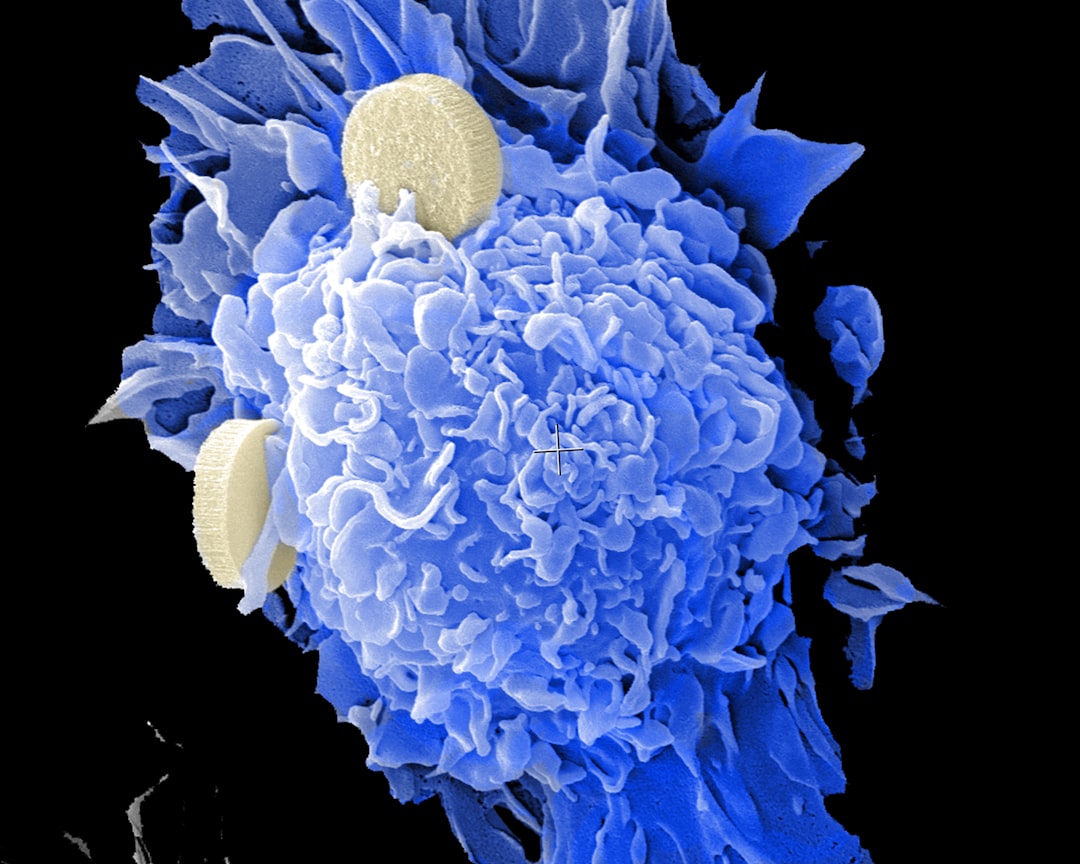

Immuno-oncology by National Cancer Institute

Developments and News

On April 23, 2025, LEAP hosted a virtual key opinion leader event featuring Zev A. Wainberg, MD (UCLA), and Cyndi Sirard, MD, to discuss unmet needs in microsatellite stable colorectal cancer and the role of DKN-01. Earlier in the month, the company held a conference call on April 7 to present interim data from its Phase 2 DeFianCe trial of DKN-01 plus bevacizumab and chemotherapy in second-line colorectal cancer. At the J.P. Morgan Healthcare Conference on January 13, 2025, CEO Doug Onsi provided updates on progress toward upcoming data milestones for both the DeFianCe trial and the DisTinGuish trial, which focuses on first-line gastric and gastroesophageal junction cancer.

Financial and Strategic Analysis

On October 6, 2025, LPTX shares closed at $0.7194, reflecting an increase of 34.85% with a trading volume of 11.8 million shares. As per the SEC Form 13F-HR filing from Simplify Asset Management Inc., institutional holdings in LEAP totaled approximately $1.99 billion as of June 30, 2025, a decrease from $2.67 billion reported on March 31, 2025. The variations in institutional holdings may relate to strategic repositioning in anticipation of clinical data. The company's future funding requirements will be influenced by clinical trial outcomes and possible partnerships with larger biopharmaceutical companies.

Market Position and Industry Context

LEAP operates within the immuno-oncology sector, where various monoclonal antibodies and checkpoint inhibitors target solid tumors. Its focus on DKK1 and Claudin18.2 distinguishes it within the field; however, approval pathways for its therapies are subject to rigorous regulatory scrutiny. As a small-cap entity, LEAP faces the challenge of balancing research and development investments with its resource limitations, making strategic collaborations and successful trial outcomes essential for continued progress.

tl;dr

On October 6, 2025, LEAP THERAPEUTICS shares increased by 34.85% to $0.7194 with strong trading volume ahead of data from the Phase 2 DeFianCe and DisTinGuish trials. Simplify Asset Management reported $1.99 billion in holdings as of June 30, 2025, indicating institutional positioning around forthcoming clinical data. The future outlook is contingent upon the outcomes of DKN-01 trials, potential partnerships, and ongoing funding to maintain its development pipeline.