Introduction

GT Biopharma Inc (NASDAQ: GTBP) is a clinical-stage biopharmaceutical company specializing in immuno-oncology. Its proprietary NK cell engager (TriKE) platform is designed to activate natural killer cells against hematologic malignancies and solid tumors, including acute lymphocytic leukemia, non-Hodgkin’s lymphoma, and acute myeloid leukemia. On October 9, 2025, the share price stood at $0.7398, reflecting a 31.50% decline from the previous close, with a trading volume of 2,904,077 shares on NASDAQ.

Corporate structure

Although GT Biopharma lists 2–10 employees on its LinkedIn profile, it leverages a seasoned leadership team and advisory board:

- Michael Breen, Executive Chairman & Chief Executive Officer, has experience in legal and wealth management from BNP Paribas affiliates and Clyde & Co.

- Jeffrey S. Miller, M.D., Consulting Senior Medical Director, is a professor at the University of Minnesota with over 170 peer-reviewed publications in NK cell biology and clinical immunotherapy.

- Alan L. Urban, Chief Financial Officer, possesses 30 years of corporate finance and accounting expertise across NASDAQ-listed life science and technology firms. Independent directors include Charles J. Casamento (biotech M&A), Hilary Kramer (investment banking and hedge funds), and David C. Mun-Gavin (private banking).

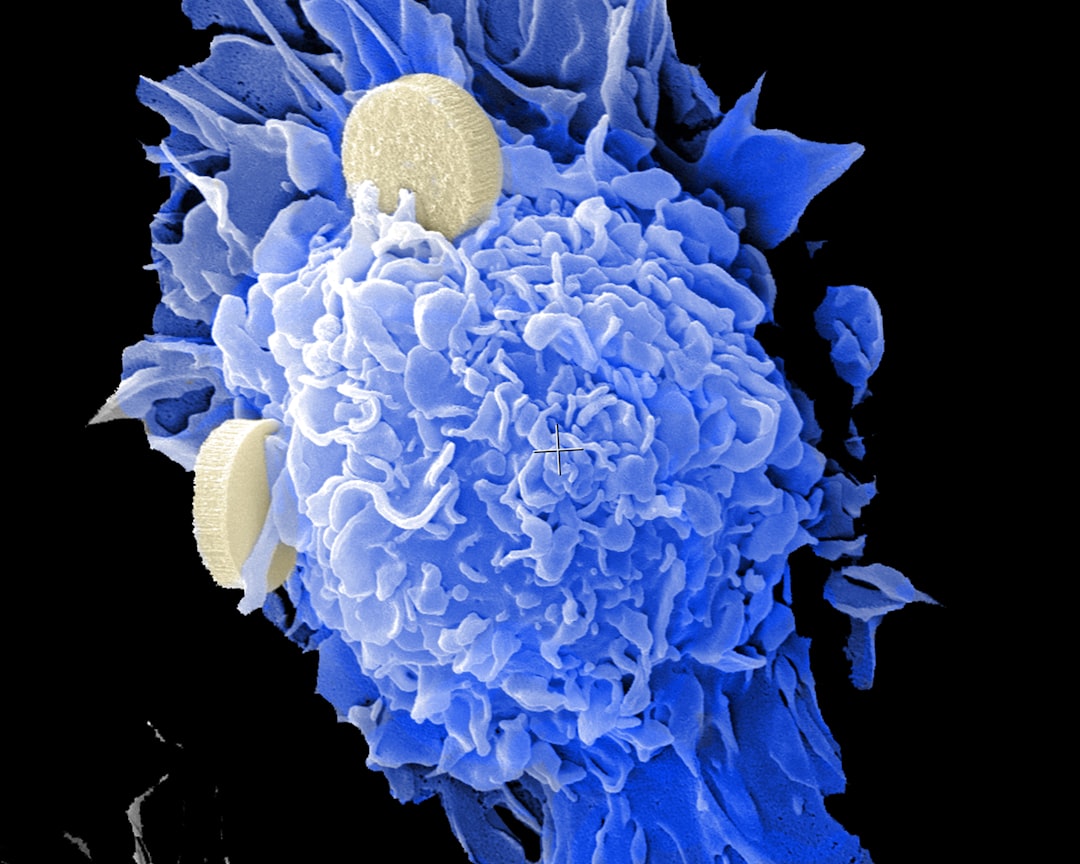

Immuno-oncology by National Cancer Institute

Recent developments and news

On October 9, 2025, GTBP shares decreased by 31.50% to $0.7398, falling below the 52-week range of $0.55 to $4.10. Trading volume reached 2.9 million shares, significantly above the average volume of 344,642. As of mid-October, no new SEC filings have been issued since the earnings window of August 12–18, 2025. The company continues to highlight its pipeline at www.gtbiopharma.com, inviting investors to review preclinical and clinical-stage programs.

Financial and strategic analysis

| Metric | Value |

|---|---|

| Share price (2025-10-09) | $0.7398 |

| 52-Week range | $0.55 – $4.10 |

| Market capitalization | $2.27 million |

| Enterprise value | –$7.50 million |

| Net income (TTM) | –$9.48 million |

| Diluted EPS (TTM) | –3.98 |

| Total cash (mrq) | $5.23 million |

| Levered free cash flow (TTM) | –$10.07 million |

| Beta (5Y) | 1.32 |

GT Biopharma has not reported product revenue and continues to operate at a net loss, with negative earnings per share and negative free cash flow over the trailing twelve months. The balance sheet shows $5.23 million in cash against no recorded debt, resulting in a negative enterprise value. Analysts’ one-year price target stands at $11.00, contingent on the timing and outcome of clinical trials. Additional capital raises or partnerships may be necessary to advance the TriKE platform.

Market position and industry context

Operating in the competitive immuno-oncology sector, GT Biopharma is an early-stage player among larger firms advancing CAR-T therapies and checkpoint inhibitors. The TriKE approach targets a niche in NK cell engagement and benefits from academic validation, but clinical-stage progress and regulatory milestones will play a significant role in determining its market position. With a small internal team, the company relies on external collaborations and advisory expertise to navigate trial design, regulatory submissions, and potential commercialization pathways.

tl;dr

On October 9, 2025, GTBP shares decreased by 31.50% to $0.7398 amid increased trading activity. The company reported $5.23 million in cash, but a cash outflow of $10.07 million over the past year. With no product revenue and negative EPS of –3.98, future equity financings or partnerships may be likely. Upcoming clinical readouts for the NK cell engager pipeline will be important for future developments.