Introduction

Apollomics Inc. (NASDAQ: APLM) is a clinical-stage biotechnology company, founded in 2015 and headquartered in Foster City, California, with additional operations in Hangzhou and Shanghai, China. The company focuses on the discovery and development of oncology combination therapies that harness the immune system and target specific molecular pathways. On October 15, 2025, APLM closed at $30.58 per share, reflecting a 65.90% increase on a trading volume of 170,793 shares.

Corporate Structure and Leadership

Apollomics employs between 51 and 200 professionals across research, clinical development, regulatory affairs, and corporate functions. Its senior leadership team includes:

- Hung-Wen (Howard) Chen, Chairman and Chief Executive Officer, who founded Gemtek Technology and previously served as CEO at Polaris Pharmaceuticals, leading a successful strategic turnaround and the company's listing on the Taiwan Stock Exchange.

- Yi-Kuei Chen, Chief Operating Officer, co-founder of Maxpro Ventures, with experience in conducting over 60 private equity transactions in biotechnology and pharmaceutical companies across the U.S. and Asia-Pacific.

- Peter Lin, Chief Financial Officer, with over 20 years of experience in biopharma finance and private equity, previously serving as CFO at Tanvex Biopharma and holding senior roles at Solarium Capital.

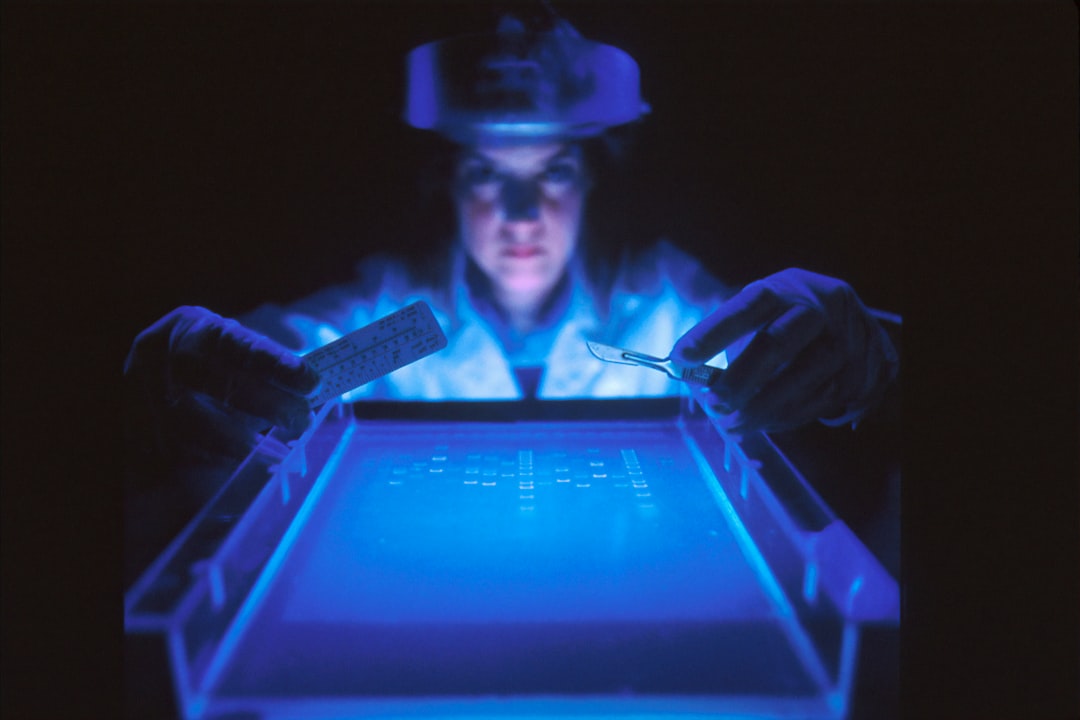

Oncology by National Cancer Institute

Recent Developments

On September 9, 2025, Apollomics filed a Schedule 13D disclosing PIPE subscription agreements with King Regent Management Limited and Hung-Wen Chen, each reporting beneficial ownership of 41.8% of Class A ordinary shares.

On September 22, 2025, Nasdaq notified the company of a potential delisting under Rule 5101, which has prompted an appeal and pursuit of compliance measures. The Grand Court of the Cayman Islands agreed to stay litigation on September 12, 2025.

On October 14, 2025, in a Form 6-K filing, Apollomics reported receiving $4.1 million in PIPE investments on September 3, 2025, enabling the company to reverse previous plans to discontinue its SPARTA clinical trial for APL-101 (vebreltinib). Management expressed intentions to advance global trial enrollment, leverage existing Chinese approvals for filings in new markets, and expand headcount from 12 to 15 employees by the end of October.

Financial and Strategic Analysis

The $4.1 million PIPE funding provides the necessary resources to sustain pivotal studies of APL-101, a selective c-Met inhibitor. Apollomics currently faces risks, including regulatory uncertainties across the U.S., China, EU, and Taiwan; potential intellectual property licensing challenges; and the need to maintain compliance with Nasdaq listing requirements. The company’s strategy focuses on completing the multinational SPARTA trial, securing additional partnerships for combination therapies, and pursuing regulatory filings beyond China for its core and ancillary assets.

Market Position and Industry Context

Apollomics operates within the oncology combination therapies sector, managing a diversified pipeline of ten drug candidates across twelve programs, which include four tumor inhibitors, two anti-cancer enhancers, and four immuno-oncology agents. Five of these candidates are currently in clinical stages. By aligning targeted small molecules with adjunctive antibodies and vaccines, the company aims to address challenges related to tumor resistance and immunosuppression. Apollomics seeks to leverage its collaborations across borders, aiming for synergies between U.S. trial capabilities and Chinese manufacturing and regulatory pathways.

tl;dr

Apollomics secured $4.1 million in PIPE funding on September 3, 2025, allowing the continuation of its global SPARTA trial for APL-101. The company has appealed a Nasdaq delisting notice received on September 22, 2025, while legal proceedings in the Cayman Islands have been stayed. APLM shares rose 65.90% to $30.58 on October 15, 2025. Management plans to complete enrollment, expand regulatory filings beyond China, and achieve Nasdaq compliance by the end of the year.