Progress in RAS-Targeted Drug Candidates as D-Day for Clinical Data Approaches in 2026

Clinical-stage precision oncology company Erasca Inc. (NASDAQ: ERAS) closed at $3.72 on Nasdaq on July 31, advancing 5.23% amid rising anticipation for its next-generation RAS-targeted oncology pipeline. Trading value reached approximately $5.2 million, and volume hit around 1.4 million shares, exceeding recent averages. Market capitalization rose by roughly $58 million to $1.0554 billion.

Clinical-stage precision oncology company Erasca Inc. (NASDAQ: ERAS) closed at $3.72 on Nasdaq on July 31, advancing 5.23% amid rising anticipation for its next-generation RAS-targeted oncology pipeline. Trading value reached approximately $5.2 million, and volume hit around 1.4 million shares, exceeding recent averages. Market capitalization rose by roughly $58 million to $1.0554 billion.

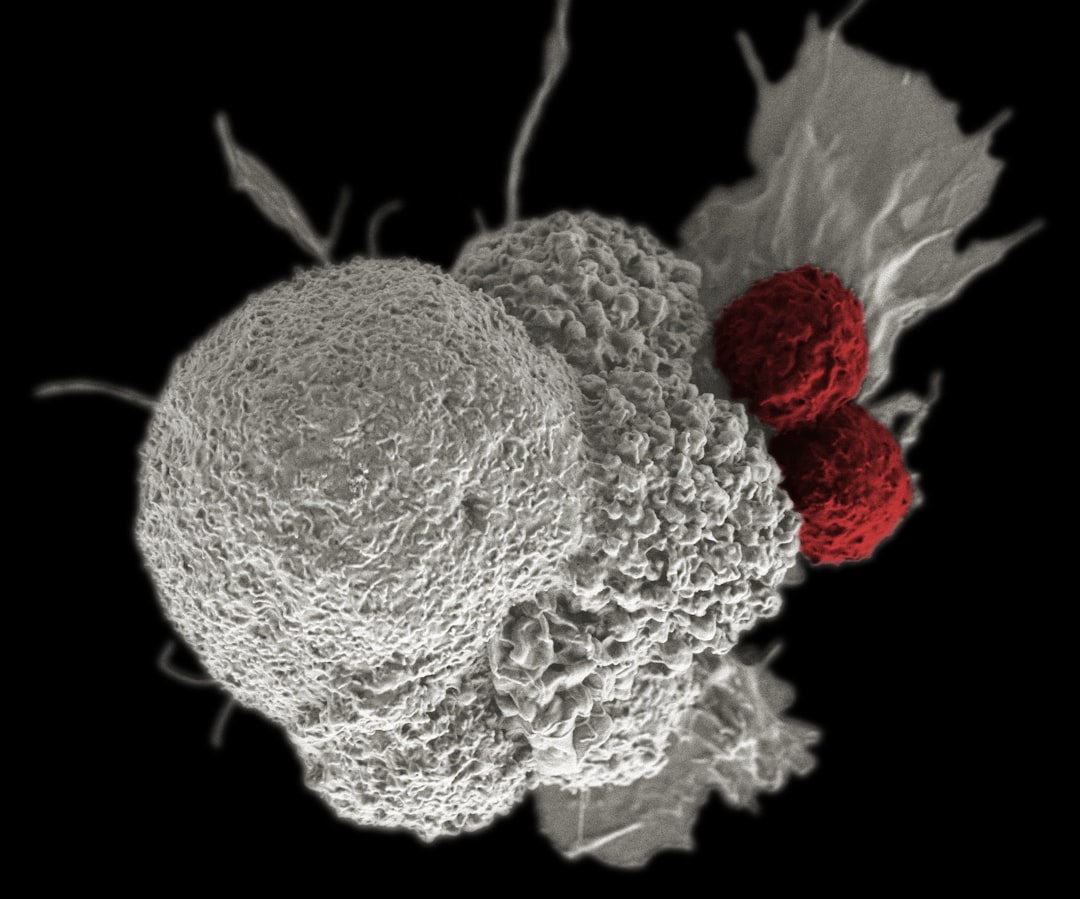

Investors focused on ERAS-0015 and ERAS-4001, which the company highlighted throughout the year. In May 2025, Erasca received U.S. Food and Drug Administration approval to initiate clinical trials (IND) for its pan-RAS molecular glue candidate ERAS-0015 and then filed an IND for its pan-KRAS inhibitor ERAS-4001. In its second-quarter 2025 report, the company announced plans to release first-in-human monotherapy data for both candidates in 2026, fueling mid-term momentum.

Over Three Years of Cash Runway Eases Dilution Concerns

Despite recurring profit-taking, Erasca’s share price regained strength as investors reassessed the company’s stable financial position. As of June 30, the company held approximately $387 million in cash, cash equivalents, and marketable securities, which it estimated would fund operations through the second half of 2028. The absence of an immediate need for large equity raises reassured small- and mid-cap biotech investors awaiting clinical readouts.

Despite recurring profit-taking, Erasca’s share price regained strength as investors reassessed the company’s stable financial position. As of June 30, the company held approximately $387 million in cash, cash equivalents, and marketable securities, which it estimated would fund operations through the second half of 2028. The absence of an immediate need for large equity raises reassured small- and mid-cap biotech investors awaiting clinical readouts.

That said, in August 2025 Erasca established an at-the-market (ATM) equity program of up to $200 million, granting it the option to issue shares opportunistically based on market conditions. While this facility enabled rapid capital raising when needed, it also represents a potential overhang if new share supply increases during price upswings.

2026 Data: Balancing Expectations and Risks

Ultimately, Erasca’s valuation hinged on the initial clinical data from ERAS-0015 and ERAS-4001, expected in 2026. Both candidates targeted the RAS/MAPK pathway and could address large markets in solid tumors such as colorectal, pancreatic, and non-small cell lung cancer. However, no human efficacy or safety data were yet available. Erasca’s compelling preclinical performance and ample cash runway supported investor sentiment, but as with any early-stage biotech, the risk of significant valuation resets remained if trials failed.

The roughly 5% share price gain and near-$14 million increase in market capitalization signaled that the market was again betting on the company’s mid- to long-term clinical story over short-term headlines. With at least a year to go before data readouts, substantial share price volatility was likely to persist, driven by clinical progress updates, partnership developments, and any utilization of the ATM program.