VF Corporation (VFC) Stock Rises on Debt Reduction

VF Corporation (VFC), the U.S. apparel and footwear brand group, saw its share price jump 5.13% to $20.19 on January 8 in New York trading. Its market capitalization climbed by roughly $427 million to about $7.9 billion, while trading volume exceeded 3.38 million shares—well above recent averages—signaling renewed investor interest.

VF Corporation (VFC), the U.S. apparel and footwear brand group, saw its share price jump 5.13% to $20.19 on January 8 in New York trading. Its market capitalization climbed by roughly $427 million to about $7.9 billion, while trading volume exceeded 3.38 million shares—well above recent averages—signaling renewed investor interest.

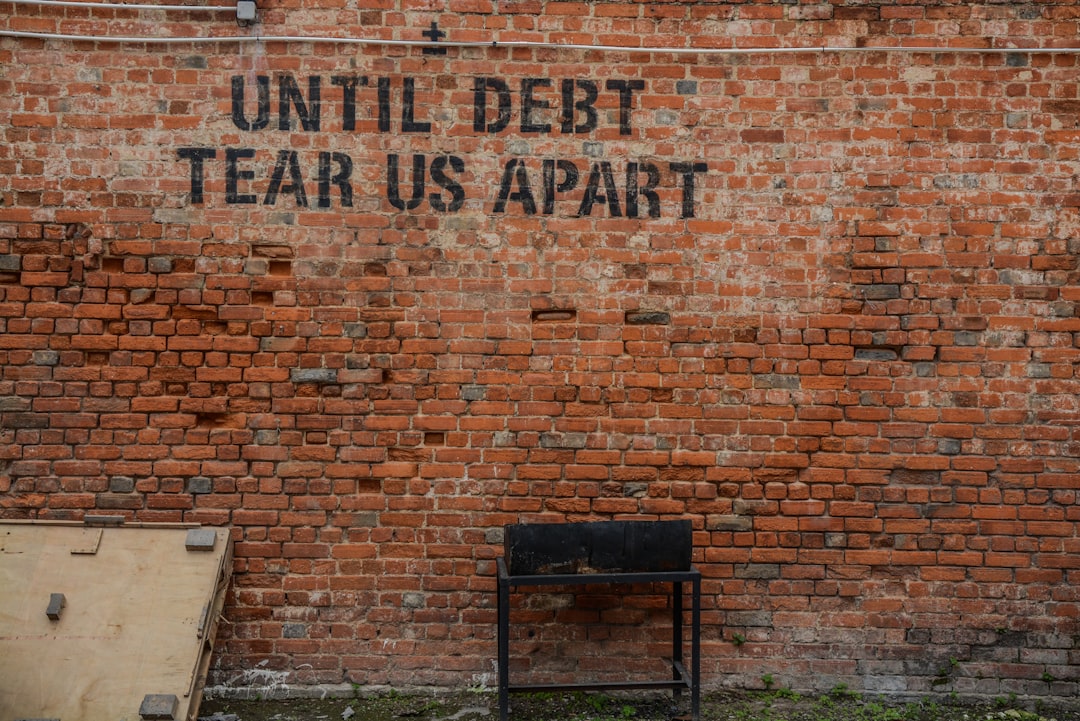

The main catalyst was debt reduction. On the same day, VF Corporation announced it will fully redeem its 4.125% senior notes due 2026 (VFC26) at 100% of face value plus accrued interest. The actual redemption is scheduled for February 7. This early retirement of high-coupon debt is viewed as a signal to reduce interest expenses and strengthen the balance sheet, prompting investors sensitive to leverage to respond positively.

The main catalyst was debt reduction. On the same day, VF Corporation announced it will fully redeem its 4.125% senior notes due 2026 (VFC26) at 100% of face value plus accrued interest. The actual redemption is scheduled for February 7. This early retirement of high-coupon debt is viewed as a signal to reduce interest expenses and strengthen the balance sheet, prompting investors sensitive to leverage to respond positively.

Analysts have turned more constructive:

- UBS raised its price target on VFC from $15 to $18 (a 20% increase) while maintaining a “Neutral” rating.

- The target hike reflects growing confidence that restructuring, cost-cutting and brand repositioning efforts are gaining traction.

- UBS cited solid performance from The North Face and Timberland, along with early signs of recovery at Vans amid its ongoing restructuring.

Many interpret the bond redemption and target-price upgrade as validation of VF’s “turnaround story” initiated last year. In its fiscal 2026 first-quarter results, CEO Bracken Darrell highlighted cost reductions, margin improvements and a 20% reduction in net debt, stating that the company is “reducing debt and restoring profitability to prepare for the next phase of growth.” The recent sale of the non-core Dickies brand has further reinforced confidence in VF’s streamlined portfolio and financial improvement.

All eyes now turn to the fiscal 2026 third-quarter earnings report due January 28. Investors will be watching to see how the financial and strategic initiatives—bond redemption and brand restructuring—translate into actual results. In the short term, shares may trade with heightened volatility around the $20 level, but the market will use this earnings release to judge whether VF’s debt reduction and brand-recovery narrative can deliver on its promise.